Thinking about selling or refinancing your home? One crucial step in either process is a home appraisal. A home appraisal is an unbiased assessment of your property’s value, performed by a professional appraiser. Various factors are taken into consideration to determine the value of your property, including its size, condition, location, and recent sales of similar properties in the area.

While some of these factors are out of your control, there are steps you can take so your home is more likely to be valued higher. In this blog post, we will explore the importance of home appraisals and provide a comprehensive home appraisal checklist to help you maximize the value of your home during this evaluation.

Be Prepared for Closing Day – Download Your Stress-Free Checklist!

Importance of Home Appraisals

Getting a home appraisal offers benefits for both sellers and those looking to refinance. If you’re refinancing a mortgage, a better home appraisal will result in a potentially lower interest rate, lower monthly payment, and a shorter payoff term. If you’re a seller, it provides you with an accurate estimate of your home’s value, allowing you to set a competitive listing price. Furthermore, an accurate appraisal attracts potential buyers and increases your chances of securing a better deal.

Preparing for a Home Appraisal

Proper preparation is essential to ensure your home is presented in the best possible light during the appraisal process. Here are some tips to help you be ready:

- Improve the Condition: Take the time to address any necessary repairs or maintenance tasks. Fix leaky faucets, replace broken light fixtures, and touch up paint where needed. A well-maintained home leaves a positive impression on the appraiser.

- Enhance Curb Appeal: First impressions matter. Spruce up your home’s exterior by mowing the lawn, trimming bushes, and adding colorful flowers. A well-manicured front yard significantly impacts the overall appraisal value.

- Clean and Declutter: Ensure your home is clean, decluttered, and properly staged. Remove personal items and excess furniture to create a more spacious, inviting atmosphere.

- Document Upgrades and Renovations: Make a list of any recent home improvements, upgrades, or renovations. Provide documentation, including receipts and permits, to showcase the added value.

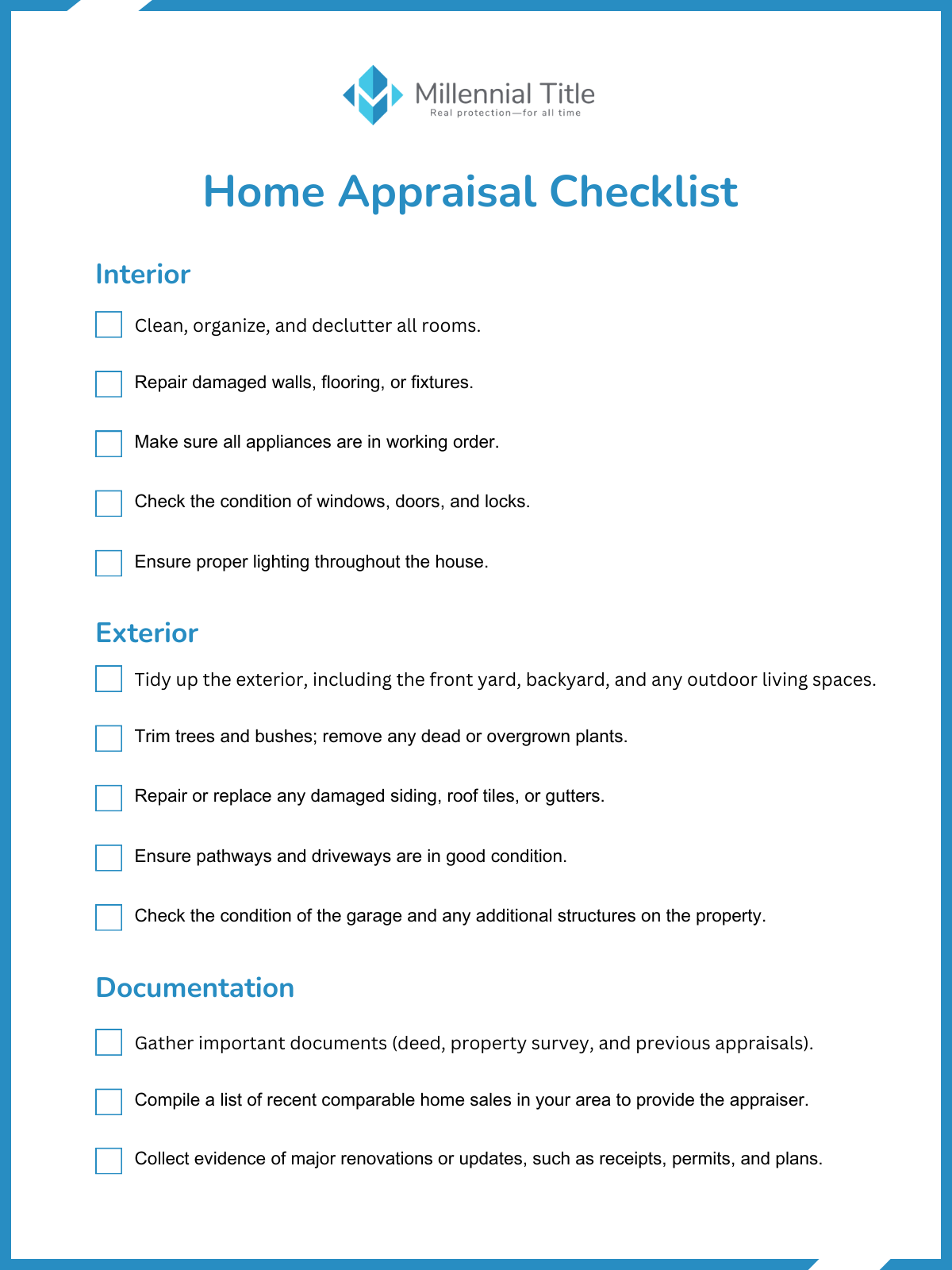

Home Appraisal Checklist

To assist you, we’ve prepared a comprehensive checklist that covers areas to prepare:

Selling or Refinancing, Millennial Title is Here to Help!

A home appraisal is a crucial step in both the home selling process and refinancing a mortgage. By understanding the importance of home appraisals and properly preparing for them, you can maximize the value of your home. And be sure to use our checklist to prepare your home for appraisal. Remember, professional assistance from the experts at Millennial Title is just a click or a call away. Contact us today to make the most out of your selling or refinancing experience.