In an increasingly digital world, staying up to date with the latest technology is top of mind for many businesses, including real estate title companies. While technology has made closings and transferring funds easier, it has also introduced a new breed of cybercriminals looking to scam homeowners during the closing process. At Millennial Title, our team works diligently to protect all parties involved in the home buying and selling process, but in order to work together, here are tips to avoid being scammed by fake wire transfers and mortgage wire fraud.

Which Title Insurance Policy is Right for You? Learn More With This Chart

What is Mortgage Wire Fraud?

Mortgage wire fraud is a type of scam where cybercriminals will pose as a member of the closing team in order to gain access to your funds. The criminal will work to convince the borrower to wire funds into a fake account during the process by using fake instructions. These wiring instructions will look like they could be coming from your real estate agent, escrow officer, or even your mortgage lender but will actually be sent to the scammer instead.

Mortgage wire fraud and fake wire transfers are performed through common hacking techniques known as phishing or spoofing.

In a phishing scam, hackers will use fake email addresses, phone numbers, or websites that impersonate someone you trust.

- For example, instead of receiving an email from [email protected], you could receive a message from @[email protected]. Did you spot the difference between the two? If you follow the wiring instructions in the fake email, then the cybercriminals will withdraw the funds and leave you with few options of getting your money back.

Similar to phishing, spoofing occurs when scammers will use software that allows them to mimic the email or phone number of your agent or lender. So the email or phone call you receive will appear as if it coming directly from them when that isn’t the case at all.

Signs of Fake Wire Transfers

Unrecognized Name

If you receive a request to wire money to someone you do not know, then do not do it! Whether they’re posing as another member of the Millennial Title team, real estate office, or bank, if you have not worked directly with this person, do not send them money because if you do, the chances of getting back are slim.

Asked Unexpectedly

Another common wire transfer scam involves impersonating friends, family members or even the government. Calls from the IRS are often scams with threats of major consequences if you do not pay.

Sometimes criminals will pose as a member of your family who has been in an accident or sick. They may seem legitimate when in reality, they just went searching to find family member names online. If you have been contacted, we recommend reaching out directly to see if the case is true. These scammers often urge you to not contact anyone and just to send the money, which is a major red flag.

Missing Information

Cybercriminals also may word the message as urgent or request same-day transfers. This is a major red flag. Our team will specify in the message the closing timeline with due dates for all paperwork in addition to the fund transfers. Additionally, team members at Millennial Title will also have an email signature detailing their name, contact information, office address, and the Millennial Title logo. If you receive an email and the signature looks to be different from previous email, please call the office directly to confirm the information.

New Wire Instructions

Often disguised as the mortgage lender, agent, or title company, scammers will send the borrow fake wiring instructions with details on how to pay your down payment and closing costs. These instructions may also request that the money be sent to an entirely different bank as discussed. If you receive an email or phone call detailing this information, please call Millennial Title or your lender directly to confirm the instructions.

How to Prevent Wire Fraud and Fake Wire Transfers

Purchasing a home is a monumental financial decision so taking precautions early on might help you avoid becoming a victim.

Gather Contact Information for:

- Seller

- Real Estate Agents

- Title Company

- Attorney

These should all be listed on the purchase agreement, but be sure to keep them on hand to compare against any future communications you may receive in the closing process.

Confirm Wiring Instructions via Phone

The wiring instructions for your down payment and closing costs will be received in writing or via email. These instructions should come with the escrow account number, property address, and the routing information for the bank. Be sure to reach out directly to Millennial Title to confirm the details of the instructions before wiring the funds. We rather you double-check than fall victim to wire fraud.

Don’t Reply or Route Money via Email

Scammers who impersonate emails may include links to confirm wiring instructions. Do not click, reply, or call any of the phone numbers listed. Reach out to the involved parties with the contact information provided at the contract signing to confirm instructions.

Do not Provide Financial Information over the Phone

It is unlikely that you would receive a phone call asking for specific financial information, to protect yourself, you can ask for their name, title, and phone number to call back at a later time. Similar to emails, use the information provided at contract signing to confirm their legitimacy.

Verify Money was Received.

Once your wire transfer has been completed, contact Millennial Title to confirm that the funds have been received.

We’re Here for You

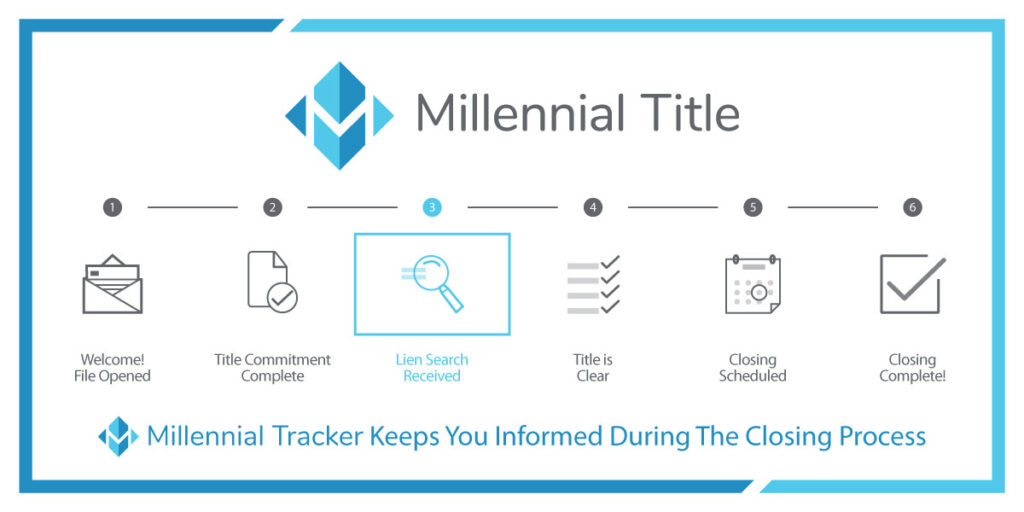

At Millennial Title, our systems are designed to protect buyers and sellers at every step of the process. By being knowledgeable and detail-oriented, homebuyers can rest assured that they are protected against these common scams. If you’re interested in learning more about Millennial Title’s closing process, please contact a member of our team today.