Demand for housing is at an all-time high. When the marketplace is hot, buying a home can become a frustrating experience. You fall in love with a house, only to find out you weren’t the first bidder, sometimes many times over. In some locations, property sells within days after being put on the housing market. This can make competing for a new home difficult, but fortunately, there are steps you can take to make it easier.

Preparing for Closing Day? Download our Checklist

Be Prepared Financially Before Making an Offer

Many buyers will take a cash offer, even if it is lower than a similar offer from someone with uncertain finances. If you can do a cash offer, this may be the best way to encourage a seller to pick you, but if you can’t, a strong pre-approval letter is the next best option.

Another option to strengthen the deal is to offer above asking. Many would-be cash buyers will offer at or below asking. By offering above asking, your offer will also stand out above the rest.

Be prepared by having your mortgage company get as much of the underwriting done as possible, and make sure you have all the necessary paperwork together yourself. This will include things like your previous tax returns, pay stubs back at least two years, and any alimony or child support you may owe. By having yourself together financially, you’ll be able to react quickly when putting in an offer on a home.

Send a Personal Letter to the Seller

A personal letter explaining why you love the home and hope to buy it can also help sway a buyer in your favor. It doesn’t have to be long, in fact short and from the heart is the best way to go about it. If the seller is considering similar offers, a warm letter letting them know how much joy their house would bring to you might help them choose you over others.

A letter to the home seller can potentially set you apart from others.

Choose a Local Lender

While a national lender may be your first thought when looking for a mortgage company, they don’t have a vested interest in keeping it local. Local companies are more likely to know others in the area you will need for your team, and will be more interested in your application compared to a company with thousands of applications floating in.

Don’t Skip on Inspections

It’s very tempting to waive your right to an inspection of the home in order to make things go more smoothly. This is a very dangerous idea, however, as you have a lot to lose should there be something wrong with the house.

An inspector’s job is to check for problems that could make owning your new home disastrous. If construction was done without permits, or if the house has a cracked foundation, buying the home could set you up for a serious loss.

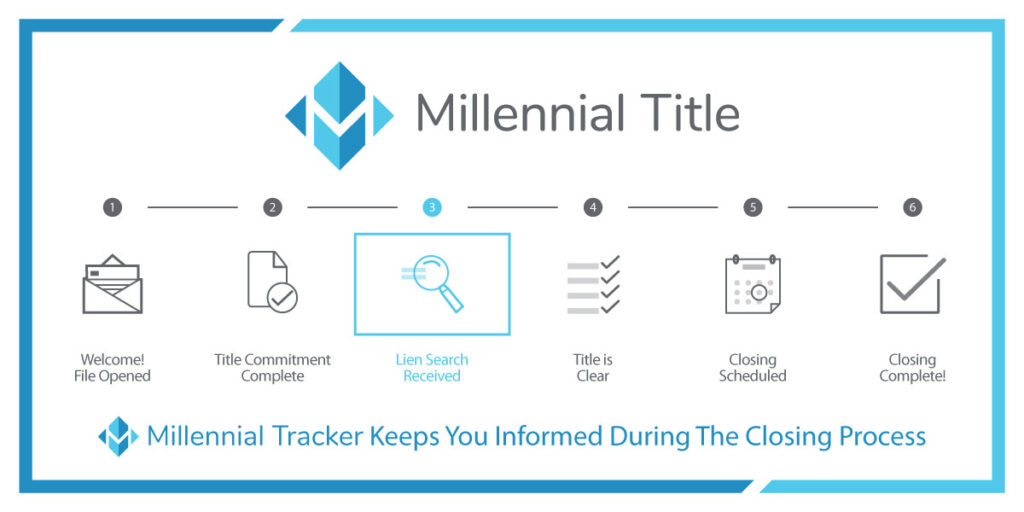

Likewise, you should always check the title before committing to homeownership. Most mortgages demand it, and even if you are doing a cash offer, it’s common sense. If you purchase the house and it turns out the people selling don’t actually have the title, you’ll be the one with the financial loss.

You also have the right as the buyer to choose the title company unless there is a specific clause in the paperwork stating otherwise. You’ll want to select one with professional experience and plenty of years in the industry so that you know their work will be something you can trust.

For title insurance advice or assistance, reach out to the experts at Millennial Title today. You’ll quickly discover why we’ve been named the fastest-growing local title insurance company in the industry.