Purchasing commercial real estate property comes with its own unique set of challenges. Complex legal descriptions, zoning challenges, building renovations, and multiple corporate owners prove that purchasing a commercial property can take some time. However, one way to alleviate some future headaches is by purchasing a commercial title insurance policy for your property. While most insurance policies protect you and your property from future circumstances, a title insurance policy protects you from what occurred long before the property was yours.

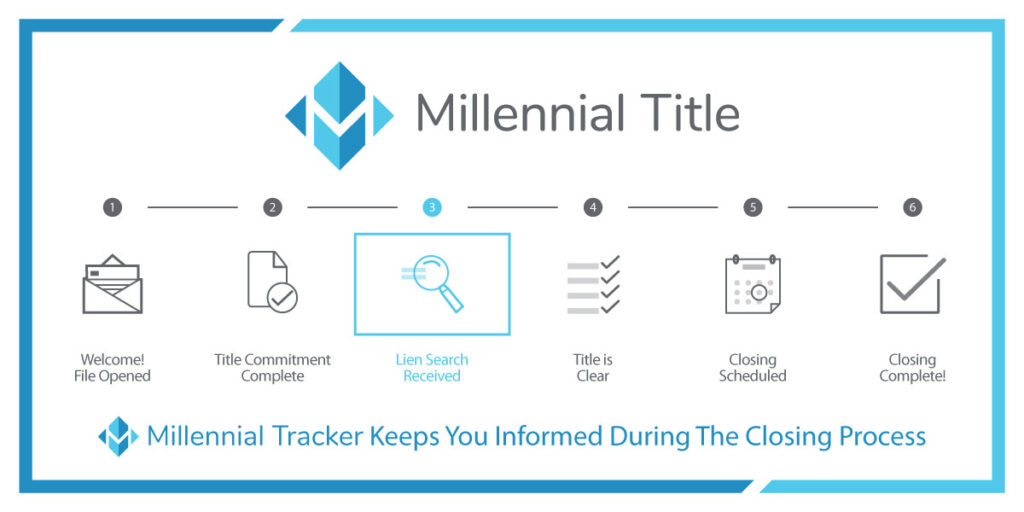

Know Exactly Where You Are in the Closing Process with Millennial Tracker

What is Commercial Title Insurance?

Title insurance is a type of insurance that protects the buyers from any issues associated with the property’s title. Title insurance is used in both residential and commercial transactions, however, because commercial properties involve much more capital, title insurance plays a crucial role in purchasing commercial properties. As previously mentioned, most insurance policies protect the policyholders from future situations whereas title insurance protects against situations that have occurred in the past such as unpaid taxes or liens against the property.

In title insurance, there are two forms of policies: owner’s and lender’s. An owner’s policy is purchased to protect the buyer if any defects arise, and a lender’s policy is used to protect the lender as long as they have interest in the property. Both owner’s and lender’s policies are one-time premiums that provide coverage for as long as there is interest in the title for the property. To learn more about the differences between the two, check out our blog, The Two Types of Title Insurance.

Conducting a Property Title Search

With every title insurance policy, the buyer will receive a title search. A title search is a thorough investigation of the property including previous deeds, mortgages, and easements. The process will also reveal any potential defects associated with the home’s title. From unpaid utility bills to encroachment notices, the title search will allow for any issues to be addressed before closing. Title insurance safeguards your investment by ensuring that it is protected from issues and claims now and in the future.

A title search will uncover any potential issues before contracts are finalized.

Commercial Title Insurance Coverage

When investing in a commercial property, protecting your investment is a top priority. With an owner’s commercial title insurance policy, you are protected against losses that may occur due to:

- Unknown title defects including title fraud, forged, unauthorized or improperly indexed deeds that prevent the buyer from possessing clear ownership of the property.

- Unrecorded liens such as unpaid utility bills, taxes, mortgages, and work orders.

- Encroachment issues and boundary descriptions inconsistent with the area being used.

- Inaccurate legal descriptions along with public record errors including title searches and inquiries

Protect Your investment with Millennial Title

Title insurance protects your commercial property from any financial loss due to unexpected issues with the title. With title insurance, you can rest assured that your investment is protected until you decide to sell the property. Millennial Title provides commercial real estate title services across the country. With in-house attorneys and a team of real estate experts, we have the experience and knowledge to manage your next commercial transaction. To learn more about commercial title insurance, schedule a closing, or learn more about our offerings, contact a member of our team today.